Joe Outlaw Testifies at House Agriculture Committee Subcommittee on General Farm Commodities and Risk Management Farm Bill Hearing

Joe Outlaw testifies before the House Agriculture Committee Subcommittee on General Farm Commodities and Risk Management on June 9, 2022.

On Thursday, the House Agriculture Committee Subcommittee on General Farm Commodities and Risk Management held a hearing to review the 2018 Farm Bill. The hearing is part of a series of hearings by the House Agriculture Committee in preparation for the 2023 Farm Bill.

Among the expert witnesses who testified was Joe Outlaw, Ph.D., professor, extension economist and co-director of the Texas A&M University Agricultural and Food Policy Center in College Station, Texas.

Subcommittee chair Rep. Cheri Bustos (D-Ill.) called the meeting to order saying that since the 2018 Farm Bill was written, farmers have experienced multiple economic impacts, including a trade war with China, marketing and supply chain disruptions caused by the COVID-19 pandemic, historic weather events, and extreme volatility in commodity and input markets — caused, in part, by the Ukraine invasion. “All of these conditions provide indications of how our current Farm Bill has been functioning,” she added.

The witnesses were asked to testify concerning how commodity programs have worked for producers as a safety net, as well as the role the Federal Crop Insurance Program has played in helping producers manage risk.

Joe Outlaw Testimony

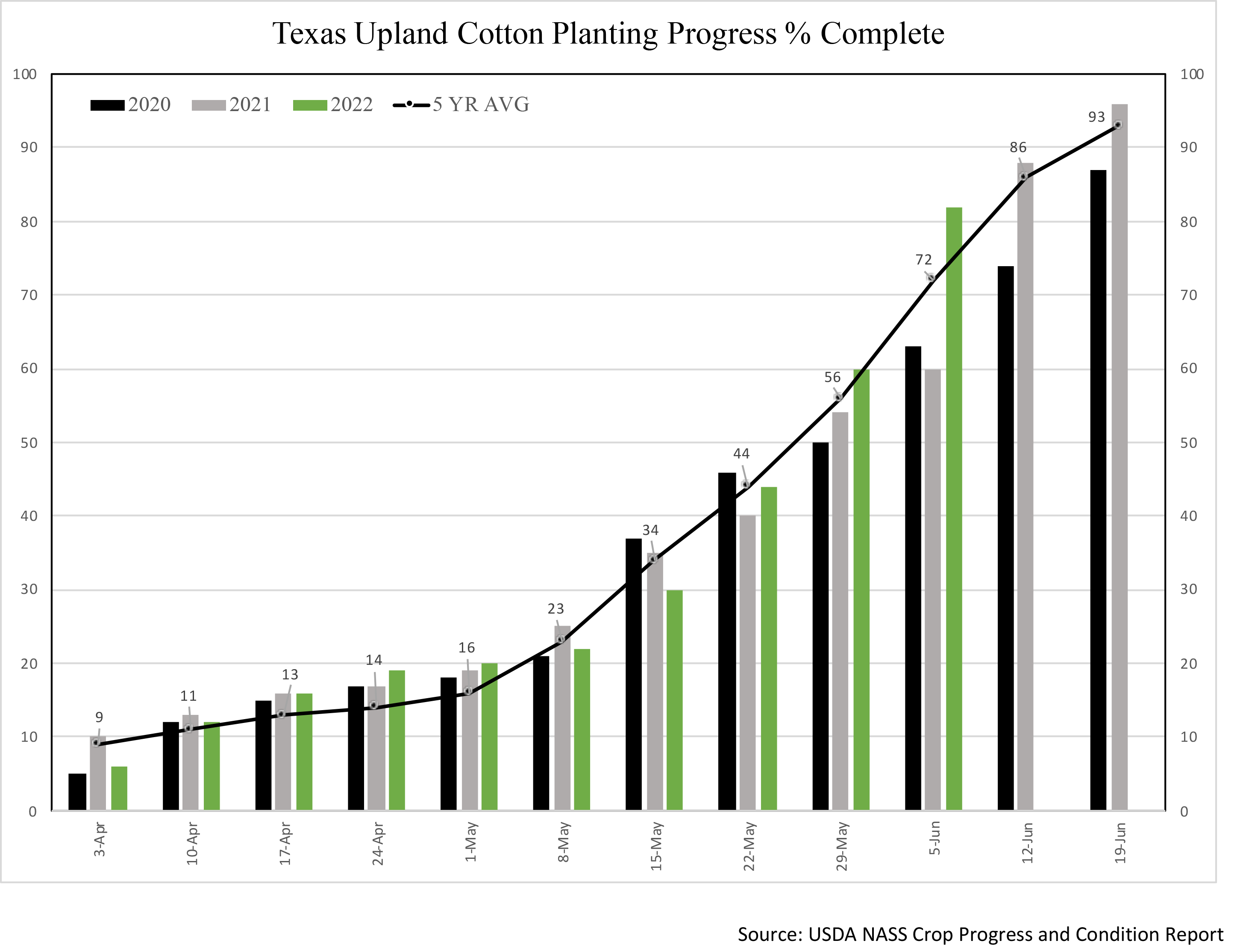

Outlaw’s testimony summarized a recent report from the Agricultural and Food Policy Center that analyzed farm profitability in 2022, relative to 2021, of 64 representative crop farms in the face of higher input and output prices. The report is titled “Economic Impact of Higher Crop and Input Prices on AFPC’s Representative Crop Farms,” and can be read here.

Key points from his testimony include the following:

- “While some producers were able to benefit by locking in input prices early in 2021 for this year’s crop, most indicated very little ability to lock in these prices even when using their normal tax management strategy of prepaying inputs. Simply put, the input suppliers would not lock in a price until the producers agreed to take delivery. Almost every respondent stated they were going to do their best to reduce input usage in the face of the highest costs of production they had ever experienced.”

- “The news is full of stories about inflation that is averaging 8.5% so far this year for the average American. The lowest year-over-year inflation farmers are seeing is twice that on seed with most categories many times higher. Commodity prices, while generally higher in 2022, are up less than 8%. If not for the incredible productivity of the U.S. farmer, there would be a major financial crisis in agriculture.”

- “Net cash farm income in 2021 included a significant amount of ad hoc assistance. Absent another infusion of assistance in 2022, we estimate that significant increases in input prices will result in a huge decline in net cash farm income in 2022 — compared to 2021.”

- “The analysis hinges on producers receiving the higher commodity prices forecasted by the Food and Agricultural Policy Research Institute with average yields. With drought being experienced across a significant portion of the country and many other areas facing excess moisture, this assumption may be overly optimistic. Having worked with farmers located across the U.S over the last 30 years, I want to make sure you understand we are talking about historic amounts of capital that farmers are putting at risk.”

- “Throughout my career, I have referred to the programs in Title I and Title XI as the three-legged stool that serves as the safety net for U.S. producers. The specific commodity programs in Title I have changed over that time, but all generally have the same objective to make-up for shortfalls in prices or incomes. The current programs, agriculture risk coverage (ARC) and price loss coverage (PLC) and the non-recourse commodity loan program, serve as two of the legs while the federal crop insurance program serves as the third leg.”

- “The following are what I believe to be the most significant shortcomings of all three legs of the stool. Most of my suggestions require additional resources that may be difficult to secure but are necessary.”

- “Price loss coverage (PLC) was established in the 2014 Farm Bill using the cost of production as the basis for setting the level of protection for each covered commodity through reference prices. Counter-cyclical price protection programs like PLC have been used in the U.S. since the 1970s with the notable exception of the 1996 Farm Bill. In the PLC program, I believe your colleagues decided to cover a significant amount (roughly 75 to 85%) of total costs of production realizing the likely negative consequences of providing price protection at higher levels. PLC rates worked fine while inflation was fairly low; however, the reference prices set in the 2014 Farm Bill and continued in the 2018 Farm Bill are in dire need of increases to remain relevant. Producers’ costs have increased substantially, and the current reference prices are not providing a relevant amount of protection.”

- “Agriculture risk coverage (ARC) was also established in the 2014 Farm Bill as a second attempt at providing producers a revenue-based safety net program to replace the overly complicated and not widely used average crop revenue election (ACRE) program first used in the 2008 Farm Bill. ARC uses a 5-year moving average of historical prices and yields to establish a benchmark that is used to determine the level of protection producers receive. While good when coming off of relatively high prices, ARC proved worthless when prices declined and remained relatively flat, providing little protection to producers. This is why that while widely chosen over PLC early in the 2014 Farm Bill, ARC was largely abandoned as a choice of safety net program in recent years. The problem with ARC is that it assumes the historical revenue levels were the appropriate levels that producers should be supported at without any basis such as protecting some level of costs for making that claim. Since ARC has the reference price embedded in the calculations, raising reference prices will make ARC more attractive as a revenue protection safety net alternative.”

- “Assuming these two alternatives are used going forward, instead of forcing producers to pick the tool (ARC or PLC) they want, I would suggest allowing them to receive the benefits of whichever is higher in a given year. This would cost nothing more than if the producers have chosen wisely and selected the appropriate tool and would take a major decision away that only serves as a major distraction to their work in trying to grow a crop. Historically high input costs have also highlighted the shortcomings of basing the safety net on prices and/or gross incomes alone. This may present an opportunity to explore adding margin coverage. However, ARC & PLC have been popular, so I would urge you to proceed with caution. Dairy offers an instructive example. Dairy margin coverage was added in the 2014 Farm Bill, but the initial version was a flop that has taken years (and a lot of money) to improve.”

- “The non-recourse marketing loan program works as it was designed more than four decades ago; however, despite modest increases for some commodities in the 2018 Farm Bill, the rates have largely remained unchanged over the past 30 years, losing ground to inflation. Providing producers the ability to take out a storage loan or receive a loan deficiency payment on a crop is a very useful marketing tool. The rates need to be raised to increase the amount of the crop that is being protected which will cost money but is significantly less expensive to do at current price levels.”

- “Federal crop insurance is an enormously successful public-private partnership that today stands as the primary safety net tool for U.S. producers. This is due to the program largely using futures prices to annually adjust the amount of protection producers can select. While crop insurance is popular with producers, the little-known secret in the farming community is that bankers “encourage” producers to purchase buy-up levels of crop insurance as a means of protecting the producer and the operating loan banks make to producers. As I have said many times in front of Congress… do no harm to crop insurance and stop outside interest groups from tying provisions of their pet projects to crop insurance – for example, linking climate change practice adoption to insurance program subsidy levels. This runs the risk of creating an unlevel playing field for producers by distorting protection levels and leaving some producers with less protection due to their lack of feasible climate change mitigation alternatives.”

- “While this hearing is about the farm bill, I would be remiss if I didn’t mention the last 5 years of ad hoc disaster assistance. I believe the upcoming farm bill provides a clear opportunity to help address some of the shortcomings ad hoc assistance was designed to address. In the case of WHIP, WHIP+, and ERP, they all essentially are designed to help cover the large deductibles producers face in their crop insurance policies. While the ad hoc assistance over the last 5 years has been vital, it comes LONG after the disaster has come and gone and has been limited to specific causes of loss. Perhaps most important, ad hoc assistance is, by definition, not guaranteed. Farmers already face enough risks and uncertainty – ideally, they wouldn’t have to guess at what the safety net might look like as they struggle to put a crop in the ground.”

To watch the livestream of the hearing, click here.

Ranking Members Boozman, Thompson Call on White House to Withdraw Brief in Roundup Case

Sen. John Boozman (R-Ark.), ranking member of the Senate Committee on Agriculture, Nutrition, and Forestry and Rep. Glenn “GT” Thompson (R-Pa.), ranking member of the House Committee on Agriculture, are calling on the Biden administration to withdraw its current brief before the Supreme Court in a case involving the Environmental Protection Agency’s (EPA) federal registration authority of Roundup, an essential glyphosate-based herbicide used for crop protection.

In a letter to President Biden, the ranking members question the White House’s rationale for filing the brief based on a “change in administration” and seek answers as to why the Solicitor General modified its long-standing position that EPA maintains federal preemption authority on all crop protection tools without consulting the relevant agency subject matter experts.

“Such a reversal coupled with the lack of consultation with subject matter experts is incredibly concerning. Simply citing a ‘change in administration’ as a cause and justification for completely undermining an agency’s federal preemption authority, clearly established by Congress, is egregious. The Solicitor General’s actions not only insert significant ambiguity into FIFRA [Federal Insecticide, Fungicide, and Rodenticide Act], but also upends a host of statutory preemption authorities and the general use of crop protection tools, and further threatens global food security,” Boozman and Thompson wrote.

The ranking members’ letter spells out the negative long-term consequences the Ninth Circuit’s decision would have should it be allowed to stand.

“If the Ninth Circuit’s decision is left in place, not only will growers lose a critical tool from their toolbox, but EPA’s registration process will eventually evolve into a state-by-state patchwork that will thwart the science-based and risk-based process Congress has specifically directed EPA to carry out. Importantly, any marketplace confusion will take place during an emerging global food crisis and growing food insecurity,” Boozman and Thompson wrote.

Read the full letter here.

West Texas Agricultural Chemicals Institute Annual Meeting Scheduled

The 70th West Texas Agricultural Chemicals Institute (WTACI) Annual Meeting will be held at the FiberMax Center for Discovery on Sept. 14, 2022.

“We have a great speaker lineup that will tackle weather, multi crop IPM, weeds and more,” said Joni Blount, WTACI president. “There will also be a panel on supply chain issues and what to expect in the future with views from distributors, fertility experts and growers.”