Emergency Relief Program’s Payment Calculations

As announced in Monday’s Cotton News, the U.S. Department of Agriculture (USDA) Farm Service Agency (FSA) announced the Emergency Relief Program (ERP) on May 16th. The ERP represents the next round of disaster assistance authorized by last fall’s Extending Government Funding and Delivering Emergency Assistance Act, which authorized $10 billion to help crop and livestock producers impacted by adverse weather conditions that occurred during the 2020 and 2021 calendar years.

The announcement is good news for producers who have been waiting more than eight months for the program. “This week’s announcement of the Emergency Relief Program has been highly anticipated for several months,” explains Kody Bessent, Plains Cotton Growers Inc. (PCG) chief executive officer. “PCG, working alongside the National Cotton Council, Congress and other advocacy groups, has been encouraging the USDA to implement the program as quickly as possible to deliver this much-needed assistance to producers.

“We appreciate FSA working to streamline the application process and incorporating the changes Congress approved. The efforts are intended to improve the program as compared to disaster assistance provided to growers for losses incurred in 2018 and 2019 through WHIP-Plus.”

Details on how the USDA FSA plans to deliver ERP are still somewhat sparse, however, the publication of the Federal Register notice announcing the availability of funds for the program, published on May 18th, paints a picture of how FSA will proceed. We now have information regarding ERP coverage factors and how payments will be calculated, as well as how FSA will apply pay limits, determine payment eligibility and other components of the program.

Simply put, the Phase 1 ERP benefit will be calculated using a similar formula as the previously implemented WHIP-Plus program and prorated by 75% to ensure that total ERP payments do not exceed available funding. Phase 1 ERP payment calculations will be based on the type and level of crop insurance obtained by the producer using the ERP factor in place of the insurance coverage level. This calculated amount will then be adjusted by subtracting the net crop insurance indemnity already received for losses minus service fees and producer-paid premiums.

Based on PCG and NCC’s interpretation of the ERP rule, below are a few regional examples of potential disaster assistance to the producer. Any discrepancy in payment once a producer receives the official USDA pre-filled application must be done by contacting their crop insurance agent if a producer believes any of the information on the form is incorrect and, as we understand the program today, the adjusted payment will be corrected in the implementation of Phase 2 ERP at a later date.

ERP Revenue Protection (RP) Upland Cotton Payment Example – Hansford County

| ERP 2020 | ERP 2020 | |

| Irrigated | Non-irrigated | |

| RP Coverage Level | 65% | 65% |

| Projected Price | $0.68 | $0.68 |

| Harvest Price | $0.69 | $0.69 |

| APH | 1200 | 500 |

| Actual Yield | 725 | 300 |

| Expected Crop Value (max(Projected Price, Harvest Price) * APH) | $828.00 | $345.00 |

| Actual Crop Value (Harvest Price * Actual Yield) | $500.25 | $207.00 |

| RP Guarantee (RP Coverage Level * Expected Crop Value) | $538.20 | $224.25 |

| RP Indemnity (RP Guarantee – Actual Crop Value) | $37.95 | $17.25 |

| RP Producer Premium | $24.40 | $15.49 |

| RP Net Indemnity (RP Indemnity – RP Producer Premium) | $13.55 | $1.76 |

| ERP Coverage Level | 87.5% | 87.5% |

| ERP Guarantee (ERP Coverage Level * Expected Crop Value) | $724.50 | $301.88 |

| ERP Indemnity (ERP Guarantee – Actual Crop Value – RP Net Indemnity) *(75% Prorated Factor) | $158.03 | $69.84 |

*Calculations based on interpretation of ERP rule by Plains Cotton Growers and National Cotton Council.

*Examples based on February projected price period and October harvest price period.

*The structure of payment calculations for WHIP+ and ERP are similar except the ERP expected crop value is calculated using the higher of the projected price and harvest price. WHIP+ only used the projected price to calculate the expected crop value.

ERP Revenue Protection (RP) Upland Cotton Payment Example – Crosby County

| ERP 2020 | ERP 2020 | |

| Irrigated | Non-irrigated | |

| RP Coverage Level | 65% | 65% |

| Projected Price | $0.68 | $0.68 |

| Harvest Price | $0.69 | $0.69 |

| APH | 1000 | 350 |

| Actual Yield | 650 | 175 |

| Expected Crop Value (max(Projected Price, Harvest Price) * APH) | $690.00 | $241.50 |

| Actual Crop Value (Harvest Price * Actual Yield) | $414.00 | $120.75 |

| RP Guarantee (RP Coverage Level * Expected Crop Value) | $448.50 | $156.98 |

| RP Indemnity (RP Guarantee – Actual Crop Value) | $34.50 | $36.23 |

| RP Producer Premium | $21.55 | $21.46 |

| RP Net Indemnity (RP Indemnity – RP Producer Premium) | $12.95 | $14.77 |

| ERP Coverage Level | 87.5% | 87.5% |

| ERP Guarantee (ERP Coverage Level * Expected Crop Value) | $603.75 | $211.31 |

| ERP Indemnity (ERP Guarantee – Actual Crop Value – RP Net Indemnity) *(75% Prorated Factor) | $132.60 | $56.85 |

*Calculations based on interpretation of ERP rule by Plains Cotton Growers and National Cotton Council.

*Examples based on February projected price period and October harvest price period.

*The structure of payment calculations for WHIP+ and ERP are similar except the ERP expected crop value is calculated using the higher of the projected price and harvest price. WHIP+ only used the projected price to calculate the expected crop value.

USDA FSA intends to start mailing pre-filled applications to eligible participants as early as May 23rd for losses incurred in 2020 and 2021. Phase 1 is based on completed crop insurance or NAP loss records. Separate application forms will be generated for each production year. Please note that FSA will mail application forms for policy holders with 2021 crop year coverage under Stacked Income Protection (STAX), Supplemental Coverage Option (SCO), Enhanced Coverage Option (ECO), Margin Protection (MP), and Area Risk Protection Insurance (ARPI) when the final data for these products becomes available.

Producers who receive ERP Phase 1 payments are required to purchase crop insurance at a coverage level equal to or greater than 60% for the next two available crop years, just as they did with WHIP-Plus. Phase 2 ERP will be implemented at a later date and will fill gaps and cover producers who did not receive payment under Phase 1 ERP, including producers who had a shallow loss that didn’t trigger an indemnity for crop insurance.

If a producer or eligible participant has any questions as the Phase 1 ERP is implemented, we encourage them to contact PCG, NCC or their local FSA office.

To download a printout of this article, click here.

EPA Looks for Farmer Feedback

The future of pesticide labels is undergoing active construction at EPA, and farmers, pesticide applicators and other ag stakeholders may have an opportunity to influence that work.

In short, EPA is tackling a long overdue project to make pesticide labels that fully comply with the Endangered Species Act (ESA), in an effort to stem a raft of lawsuits that has bogged the agency down in federal courts, trying to defend its pesticide registrations. That means labels and registrations will include mitigations and restrictions designed to protect certain endangered species and critical habitats that the agency identifies as at risk from pesticide use.

Many ag stakeholders are nervous to see what these new, ESA-compliant pesticide labels might look like, especially after the debut of new Enlist herbicide labels in January took many off guard with dozens of banned counties. (See more on that here: https://www.dtnpf.com/…).

EPA recently rolled out a work plan, designed to explain just how the agency will go about making these new, ESA-compliant labels. You can read the whole thing here: https://www.epa.gov/….

But for a quicker read, here are the top three things to know — how farmers get a say, what pesticides are the first to be affected and how you can stay tuned to the process.

FARMERS AND OTHER AG STAKEHOLDERS GET A SAY

EPA is especially interested in farmer and other pesticide users’ feedback on what “ESA-compliant” labels look like, said Jan Matuszko, EPA’s acting director of the Environmental Fate and Effects Division (EFED).

“Your input is the key to our ability to identify practical yet effective mitigations that folks on the ground can actually implement,” Matuszko told listeners on a May 16 webinar, designed to explain the EPA’s ESA work plan and its impact on growers.

Already, EPA has received lots of feedback that county-level bans on entire pesticides, such as were issued with the Enlist herbicides, are deeply unpopular and viewed as impractical and overly harsh by the farming community. Most of the initially banned counties were eventually put back on the Enlist labels after new data was presented to the agency. But the experience has left some farmers feeling vulnerable to losing pesticide access.

To avoid future label requirements like that, EPA is exploring ways for farmers to “offset” any harm to endangered species by their pesticide use. That could mean building or maintaining additional habitat for listed species, Matuszko said.

That’s a big change from how EPA pesticide use requirements have worked in the past, and the agency is still figuring out if it is legal and how it would be implemented, added Jake Li, deputy assistant administrator for EPA’s Office of Pesticide Programs. But for now, the agency is interested in pilot projects with ag chem companies and farmers to determine whether or not this is a feasible ESA mitigation option, he said.

“What we’re hoping through a pilot project … is to demonstrate how all of that plays out in real life and we are also hoping in [the] not-too-distant future to actually put some of this down on paper so that you all can see what that process looks like [and] what are the standards are,” he explained.

Other pilot projects are getting underway, as well, Matuszko said. They will allow EPA to see how certain current farm practices, such as buffer strips or cover crops, help mitigate pesticide run-off and risks to nearby endangered species. (Some of these practices are already listed as runoff prevention requirements on the new Enlist herbicide labels. See page 4 of the label here: https://www.cdms.net/…).

The agency hopes to have a website listing those pilot projects and giving the ag community information on how to participate soon. “Stay tuned,” Matuszko said.

WHICH PESTICIDES WILL BE AFFECTED FIRST?

EPA is struggling with its workload, officials admitted.

“We have an enormous backlog of past, current and future regulatory decisions that require ESA compliance and not enough resources or processes to meet the requirements all at once,” Li explained. “So that is why under the work plan we describe for the first time what we can do with our resources and just as importantly, what we’re not going to get around to doing immediately.”

First up?

“Our highest priority is to meet litigation-related commitments,” Matuszko explained. That means the EPA will first work on meeting “court-committed” deadlines for ESA-compliant labels for 18 pesticides, listed on page 68 of its work plan.

They include common ag pesticides such as atrazine, glyphosate, and neonicotinoids. Expect to see labels with new ESA requirements for these pesticides first.

EPA’s next highest priority for ESA-compliant labels are new active ingredients. As of January 2022, no active ingredient will be registered by the agency without going through a full ESA evaluation. For more details on what that process looks like, see this DTN story: https://www.dtnpf.com/….

Finally, as EPA cycles every pesticide through its routine, 15-year registration review, it will begin the task of evaluating each one for effects on endangered species, Matuszko said. That means, ultimately, all pesticides will go through this.

HOW FARMERS CAN GET THEIR FEEDBACK TO EPA

EPA has been hosting webinars and listening sessions on its pesticide work for the Endangered Species Act. The webinars have fielded more than 200 listeners each so far, many of them from the ag community, who were free to comment and ask questions. See one from January here: https://www.epa.gov/… and watch for the posting of the May 16 one here: https://www.epa.gov/….

Farmers can also get feedback to EPA on its pesticide work via their state regulators, found here in the Association of American Pesticide Control Officials: https://aapco.org/….

EPA also publishes its various pesticide registration decisions — including ESA actions — in the Federal Register and accepts public comment on them, said Elissa Reaves, director of EPA’s Pesticide Re-Evaluation Division. Farmers can keep up to date with these publications by subscribing to the agency’s Office of Pesticide Programs’ news alerts here: https://www.epa.gov/….

Finally, the USDA’s Office of Pest Management Policy accepts feedback here: https://www.usda.gov/…, and the Farm, Ranch, and Rural Communities Federal Advisory Committee holds regular meetings that welcome public participation on many issues, including EPA’s pesticide work. See more here: https://www.epa.gov/….

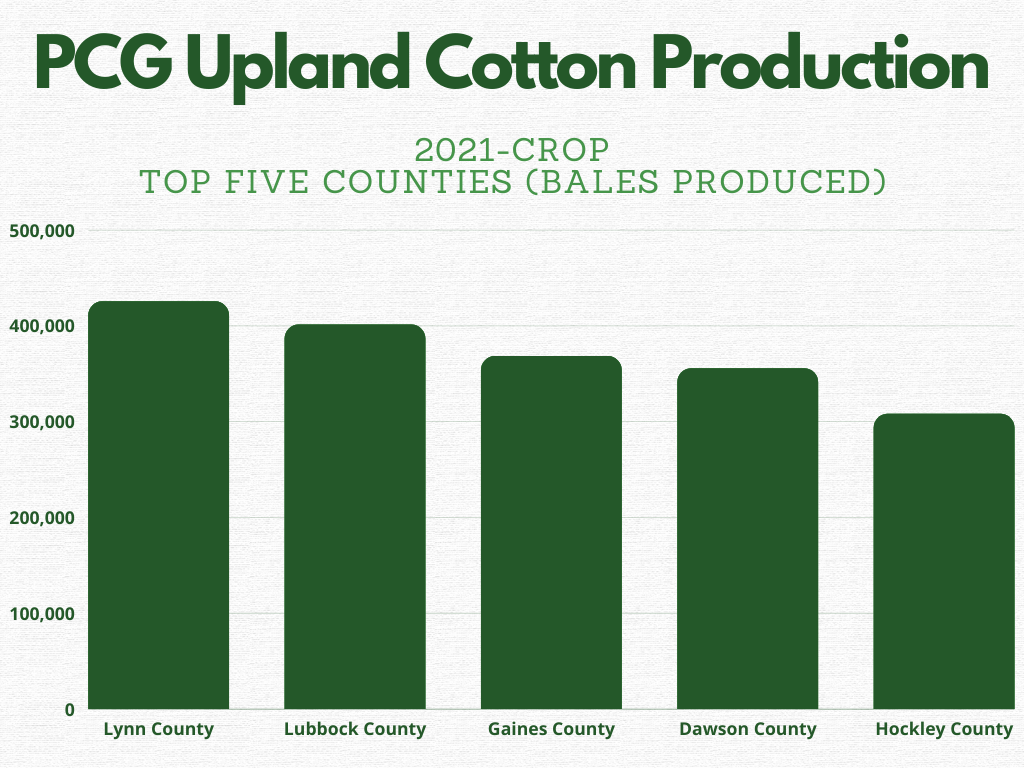

Upland Cotton Production for 2021-Crop; 2022-Crop Estimates

2021 Production

The U.S. Department of Agriculture (USDA) reported 2021 upland cotton production at 17.191 million bales nationally — an increase of 3 million bales from 2020. For the 2021 season the Plains Cotton Growers Inc. 42-county service area produced 4,592,515 million bales, after planting 4,011,501 acres and harvesting 3,457,749 of them. Lynn County came in at the top with 452,200 bales followed by Lubbock and Gaines Counties. A complete list of 2021 cotton production from PCG’s 42-county service area is available for download here.

2022 Projection

According to the National Cotton Council, the U.S. Department of Agriculture (USDA) projects 2022-2023 U.S. upland cotton production to be 16.5 million bales. Mill use is projected at 2.5 million bales, while exports are projected to be 14.5 million bales. The estimated total offtake stands at 17 million bales. With beginning stocks of 3.4 million bales, this would result in U.S. ending stocks of 2.9 million bales at the end of the 2022 marketing year and a stocks-to-use ratio of 17.1%.

The High Plains is expected to plant roughly 4 million acres this season.