2021 Classing Season Evaluated; Preparation for 2022 Discussed in Meeting with USDA-AMS

The 2021 crop year will be memorable for years to come: timely rain and above-average yields combined with the most prolific and unprecedented upheaval of the global economy in history — triggered by the COVID-19 pandemic.

The cotton classing division was not immune to these economic struggles facing labor shortages, supply chain issues and operation/efficiency issues. Traditional classing timelines were heavily impacted as well as dissemination of final data records, which ultimately led to a delay in cotton marketing.

On May 11, 2022, U.S. Department of Agriculture Agricultural Marketing Service (USDA-AMS) Cotton and Tabaco Program Deputy Administrator Darryl Earnest and his team — associate deputy administrators Ronald Robbins and Monica Alexander and deputy director of grading Byron Cole — came to the Plains Cotton Growers Inc. office in Lubbock. At the request of PCG and other Texas cotton industry organizations, they came to review the 2021 classing season and discuss plans for 2022, including the opening of the new cotton classing facility In Lubbock.

USDA-AMS classed roughly 17 million samples, 8.38 million of which came from Texas. USDA-AMS strives to achieve a 72-hour turnaround on classing samples — from the time the sample arrives at the classing office until the classing record is on file.

Few offices were able to meet the 72-hour goal consistently during the 2021 season. According to USDA-AMS, the main causes for delay in service last season were:

- Shortage of available seasonal labor

- Absenteeism

- Frequent turnover

- Low productivity while training new employees

- Delays in getting vital equipment serviced or repaired (an air dryer in the Lubbock office broke down and it took a week to repair instead of the normal time of one day)

- Delays in arrival of needed parts and materials

In hitting the 72-hour target, Lamesa was the most successful, meeting the goal 70% of the time. The Abilene and Lubbock offices struggled, coming in at 37% and 13%.

For the season, USDA-AMS regional classing offices in the PCG region reported averages for the number of days received samples waited to be classed:

Abilene: 5

Lamesa: 2.4

Lubbock: 8.5

The maximum number of days that samples waited to be classed:

Abilene: 11.5

Lamesa: 6

Lubbock: 18

Labor Challenges

The 2021 crop year saw unprecedented labor shortages across the board — classing offices across the country were no different. “There were significantly fewer seasonal labor applicants than in previous years,” Earnest said. “I’ve never seen anything like the labor challenges we faced in 2021 in more than 30 years of working here.”

The classing process has always operated off a three-shift system, Earnest said. Yet for the 2021-crop, only one facility (the Macon, Georgia office) was able to partially staff the third shift. All offices left their applicant registers open the entire season to acquire additional labor, but few candidates applied.

Potential Solutions to Labor Challenges

For the coming year, Earnest said that USDA-AMS will raise its minimum wage to $15 per hour, which affects 72% of the agency’s seasonal work positions. “We’re hopeful this will make us more competitive in filling positions for this year’s classing season,” he added. They are also working on additional incentive-based programs to offer in the coming year, while also taking a more innovative approach to reaching potential candidates.

To help offset some of the absenteeism, USDA-AMS is considering more flexibility in shift schedules to meet the needs of workers juggling multiple jobs or college students. Alexander met with the Texas Tech University College of Agricultural Sciences and Natural Resources on May 10th to discuss a possible collaboration between local classing offices and college students seeking work experience and college credit.

USDA-AMS will be increasing its permanent staff as well, while also cross-training them to manage multiple duties. They are planning to invest in multiple permanent graders who can also float to fill other positions as needed. “One thing to keep in mind is that we are looking to hire a capable and secure seasonal and permanent labor force,” Earnest added. “We’re not just looking for warm bodies. We need people who can do this job efficiently so we can serve our customer base.”

Automation should also offset some labor challenges, especially in the new Lubbock classing office. Whereas the old classing office needed 55 employees to be considered fully staffed, the new facility will only need 34. USDA-AMS is looking to renovate other classing offices to achieve this same efficiency in the future.

In response to industry requests, USDA-AMS sent out weekly updates on the status of classing operations to all gins during the 2021 season. They plan to do this again for 2022, starting at the beginning of classing season. These updates will include classing status, samples received, total carryover, days behind and any pertinent information about local office operations.

PCG requested that additional explanations about labor or equipment challenges be included in the updates to provide context behind the numbers to further benefit PCG members. USDA-AMS said that would investigate the best way to present this information.

Classing Fees to Increase

Given the rising operational costs, increasing the minimum wage and equipment costs, Earnest announced that USDA-AMS will be raising its classing fees by 20 cents — from $2.30 per bale to $2.50 per bale.

The price increase will take effect on July 1, 2022.

New Lubbock Classing Office

USDA-AMS Lubbock Classing Office Area Director Danny Martinez and his team are currently moving into the new Lubbock classing office, which

USDA-AMS Cotton and Tobacco Program Deputy Director of Grading Byron Cole shows North Gin’s Jordy Rowland and Edcot Gin’s Phillip Kidd cotton samples the new Lubbock classing office will use to test the machines in the coming weeks.

will now be located on Texas Tech University campus.

Martinez, along with Earnest, gave PCG and associates an early tour of the new building and what the revamped classing process will look like.

Earnest explained that everything in the new facility was designed with conservation in mind. Recyclable materials were used throughout the

building. Designed into the new facility is a one-of-a-kind HVAC system, which is specifically engineered to make the most efficient use of energy

throughout the operation.

The Lubbock classing office intends to have a grand opening in August 2022. PCG will have a video tour available so stay tuned.

USDA Announces Emergency Relief Program

The U.S. Department of Agriculture (USDA) announced today that commodity and specialty crop producers impacted by natural disaster events in 2020 and 2021 will soon begin receiving emergency relief payments (likely in June) totaling approximately $6 billion through the Farm Service Agency’s (FSA) new Emergency Relief Program (ERP — formerly known as WHIP+).

How to Apply — Phase 1

To simplify the delivery of ERP Phase 1 benefits, FSA will send pre-filled application forms to producers whose crop insurance and NAP data is already on file because they received a crop insurance indemnity or NAP payment.

This form includes eligibility requirements outlines the application process and provides ERP payment information.

Producers will receive a separate application form for each program year. Receipt of a pre-filed application is not confirmation that a producer is eligible to receive an ERP Phase 1 payment. Producers will need to return completed and signed ERP Phase 1 applications to their local FSA county office.

Producers must have the following forms on file with FSA within a deadline that will be announced soon:

- Form AD-2047, Customer Data Worksheet

- Form CCC-902, Farm Operating Plan for an individual or legal entity

- Form CCC-901, Member Information for Legal Entities (if applicable)

- A highly erodible land conservation (sometimes referred to as HELC) and wetland conservation certification (Form AD-1026 Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification) for the ERP producer and applicable affiliates.

Most producers — especially those who have previously participated in FSA programs — will likely have these required forms on file. However, those who are uncertain or want to confirm should contact their local FSA county office.

In addition to the forms listed above, certain producers will also need to submit the following forms to qualify for an increased payment limitation or payment rate:

- Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs.

- Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, for the applicable program year.

How Payments are Calculated — Phase 1

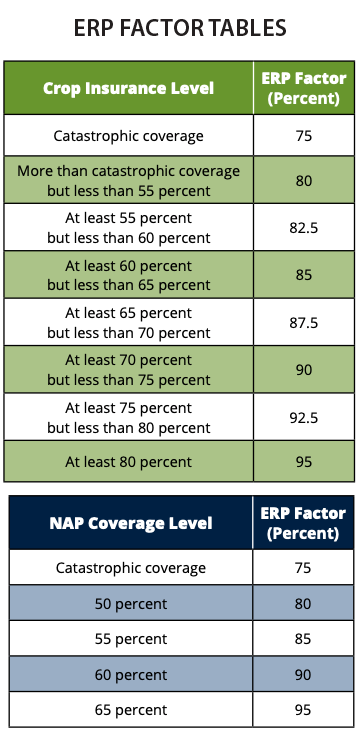

ERP Phase 1 payments for crops covered by crop insurance will be prorated by 75% to ensure that total ERP payments, including payments under ERP Phase 2, do not exceed the available funding. ERP Phase 1 payments for NAP-covered crops will not be prorated due to the significantly smaller NAP portfolio that only covers smaller acreages and specialty crops that are not covered by crop insurance.

USDA Risk Management Agency (RMA) and FSA will calculate ERP Phase 1 payments based on the data on file with the agencies at the time of calculation. The ERP Phase 1 payment calculation for a crop and unit will depend on the type and level of coverage obtained by the producer. RMA and FSA will calculate each producer’s loss consistent with the loss procedures for the type of coverage purchased but using the ERP factor in place of the coverage level. This calculated amount would then be adjusted by subtracting out the net crop insurance indemnity or NAP payment, which is equal to the producer’s gross crop insurance indemnity or NAP payment already received for those losses minus service fees and premiums.

For more information, visit the ERP fact sheet.